There are multiple approaches to achieving IT infrastructure modernization, but the end goal is always consistent: to transform the business and boost its agility and competitiveness in the dynamic marketplace.

Now imagine this scenario:

Sean wants to take a bank loan and starts searching online.

He is flooded with options, each enticing him with low-interest rates, low processing fees, and other deals.

He is flummoxed and wonders which he must choose.

But then, a chatbot pops on his screen, offering to help him find the best deal. It speaks to him in his preferred language and asks questions about his financial goals and needs.

He then receives personalized offers and recommendations, tailored exactly to his needs.

Sean is delighted. Not only were his needs met, but he also didn’t have to step out of his home and wait in a queue to speak to a banker!

This is the power of digital transformation in the banking and financial services industry. By embracing modern technologies like conversational AI (Artificial Intelligence), machine learning, and cloud computing, banks can provide their customers with hyper-personalized experiences, automate fraud detection and anti-money laundering, and optimize operating costs.

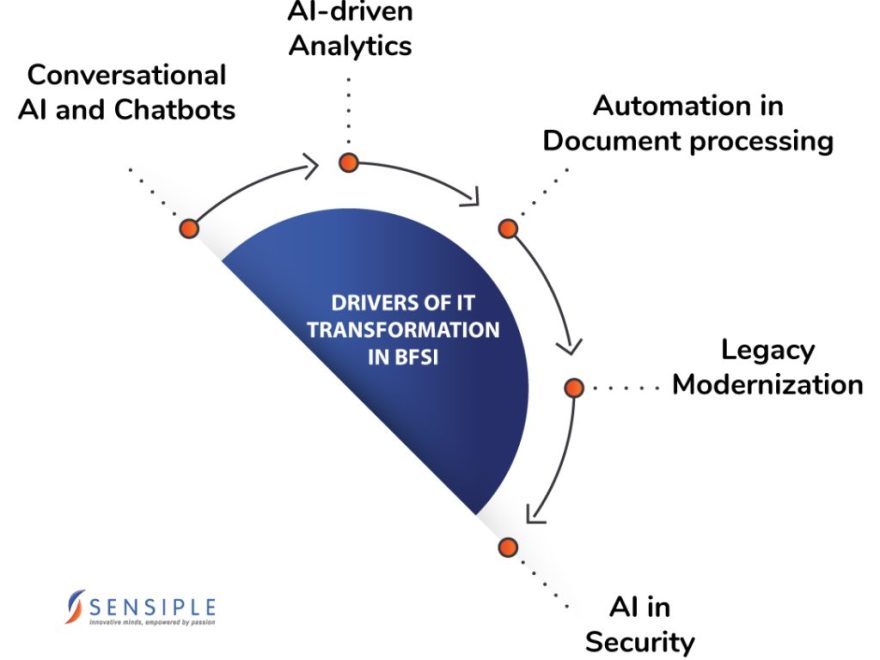

Let’s take a closer look at how digital IT infrastructure modernization is revolutionizing the BFSI industry and what are the factors driving it.

1) Conversational AI and Chatbots

With the awareness of Generative AI spreading like wildfire in recent years, people are scrambling to find out how it can help their businesses. Banks and financial services are no exception, with many of them increasingly looking towards AI to innovate and enhance their products and services to provide an exceptional customer experience. One of the ways banks are doing this is by using AI-based chatbots and voice bots. These bots can handle a wide range of customer requests, from simple tasks like resetting your password or blocking a lost card to more complex inquiries that require human attention. And the best part? They can do it all simultaneously, which means you don’t have to wait on hold for ages.

A leading bank in the U.S. has recently launched an AI-enabled Smart Voice Assistant embedded in its Android and iOS app, which allows users to carry out banking requests using conversational language. It’s like having your very own digital bank teller right in the palm of your hand.

But bots aren’t just making things easier for customers – they’re also helping contact center agents do their jobs more efficiently. By using chat or voice bots to draw up relevant information from CRMs, agents can quickly find solutions for customers and resolve queries smoothly. And for those complex queries that require human attention, bots can route the query and escalate the case to the right agents.

2) Personalization through AI-driven Analytics

AI and machine learning are revolutionizing the BFSI industry by helping them develop innovative service channels that create personalized customer journeys and promote financial empowerment. Banks are now using bots with sentiment analysis and multi-language support, offering customers branch-like services that are convenient and hyper-personalized.

With advanced AI-driven smart analytics and Big Data analytics, banks can now analyze customer needs, behavior, and profiles to suggest suitable financial products and services. Machine learning and natural language capabilities enable accurate discovery of the customer’s intent, facilitating engagement beyond basic interactions and contextual engagement that improves customer experience.

For instance, voice assistants powered by AI can determine a customer’s eligibility for loans, enable disbursal, and track EMIs. Chat and voice-enabled bots can also offer intelligent savings and investment advice based on customer data. These technologies make it possible for banks to offer tailored customer journeys and enhance their customer experience.

3) Automation in Document processing

Every day, the BFSI industry deals with a deluge of documents, ranging from basic forms to complex financial reports, legal agreements, and trust documents. However, handling these documents can be an incredibly time-consuming and costly process. Cognitive Document Processing utilizes advanced machine learning and artificial intelligence technologies to provide an end-to-end solution that can quickly and securely organize, ingest, and evaluate various types of documents. This approach is a game-changer in terms of efficiency and cost-effectiveness.

AI-enabled tools can now understand both structured and unstructured documents, including machine print and cursive handwriting. Customization of these tools makes it possible to extract tables, structures, and key-value pairs, all while working both on-premises and in the cloud.

4) Legacy IT Infrastructure Modernization on the Cloud

The BFSI landscape is getting tougher to navigate with many new entrants jostling for market share. These modern financial enterprises are disrupting the industry with personalized digital banking services that are both convenient and cost-effective, making it essential for traditional banks to modernize their operations to survive and thrive.

To stay ahead of the curve and ensure long-term profitability, banks must embrace cutting-edge technologies that enable them to remain agile and responsive to changing market demands. What does such modernization entail?

- Cloud Migration

Outdated legacy systems can be a significant obstacle to innovation, making it difficult to adapt to new technologies and market trends. Migrating to cloud computing can help banks overcome these challenges by providing a flexible, scalable, and cost-effective platform for delivering services to customers. By moving their systems to the Cloud, banks can also take advantage of the latest technologies and innovations, ensuring that they remain competitive and relevant in an ever-changing landscape. - AIOps

Artificial Intelligence for IT Operations is an emerging field that uses machine learning and analytics to automate and optimize IT operations. By implementing AIOps, banks can identify inefficiencies and performance bottlenecks in their cloud infrastructure and take proactive steps to address them. This not only improves the overall performance of their systems but can also help reduce costs by identifying areas where resources are being underutilized. - Low-code app development

Low-code app development platforms provide a rapid and flexible way to build and deploy new applications. By using low-code platforms, banks can quickly and easily create customized apps that meet the unique needs of their customers and do so at a lower cost than traditional development methods.

5) AI in Security & Compliance

Modern technology also enables banks and financial services businesses to meet the growing need for security and to keep up with constantly evolving compliance regulations. They can use AI to identify suspicious activities by detecting anomalies in transaction patterns. By training an AI model on a continuous stream of incoming data, it can understand what normal levels of banking activity are and can alert human agents if there’s any deviation from expected trends. For example, if there’s a sudden surge in a person’s account balance or multiple transactions from different locations, the AI system will flag it for review by a human agent.

Another way banks and financial institutions use AI is through “behavior profiling.” By studying customer transactions, merchants, and other entities, AI can build a profile to detect anomalous activity. This approach provides valuable insights into what types of transactions are typical for a particular customer, making it easier to spot transactions that don’t fit the norm. Further, analyzing transaction data through predictive analytics can also identify high-risk transactions and alert human agents to act. And if there’s any fraud detected, prescriptive analytics can recommend what actions should be taken to prevent it from happening again.

To recap, IT infrastructure modernization is an essential undertaking for businesses aiming to remain pertinent and competitive in the rapidly evolving realm of technology, and selecting the appropriate strategy can aid them in attaining their goals and flourishing in the dynamic marketplace.

How Sensiple can make a difference to your BFSI business?

At Sensiple, we’re keen on using cutting-edge technology to transform businesses across all industries, with a particular focus on the banking and financial services sector. As a global IT company, we specialize in contact center technology, cloud services, conversational AI, and business automation, and leverage our expertise in AI, ML, and analytics to build innovative platforms and solutions that streamline operations and enhance the user experience. Our advanced solutions, powered by robust cloud platforms like MS Azure, Google Cloud Platform, and AWS, enable the BFSI industry to offer highly personalized customer journeys that increase customer satisfaction while preventing fraudulent activity.

We provide AI-driven managed services that help companies in the BFSI sector modernize their applications, automate their business processes, migrate to the cloud, increase agility, and reduce costs.

If you’re interested in learning more about how our advanced solutions and managed services can transform your business, get in touch with us today to schedule a personalized consultation with our experts.